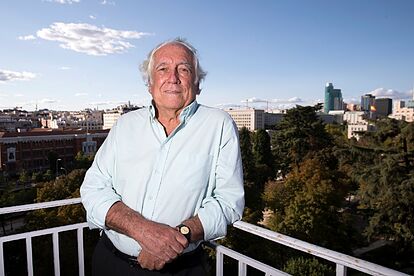

Carlos Espinosa de los Monteros: Current Situation of the Automotive Sector in Spain and Worldwide

President of Daimler-Chrysler and Honorary President of the Círculo de Empresarios.

On February 2, we had the presence of Mr. Carlos Espinosa de los Monteros, President of DaimlerChrysler and Honorary President of the Círculo de Empresarios. His presentation, titled “Current Situation of the Automotive Sector in Spain and Worldwide,” mainly focused on the evolution and functioning of the sector.

The automotive industry. The first automobile was created in 1886 and patented in Germany, and since then its development has been rapid. It has been an innovative, investment-intensive, and highly active industry. However, it currently faces many financial difficulties, including stock market declines and workforce reductions.

The context. The speaker explained that the Spanish state has collected more than 2 trillion euros in taxes from this sector, using it to finance its deficit. He also detailed the situation of the vehicle sales market worldwide. For example, in the OECD, the population is stagnant, so automotive demand is stable. However, in Asia, especially in China, there is currently an increase in demand. Another issue that greatly concerns car manufacturers and that the speaker emphasized is fuel. According to studies, there would only be oil on the planet for another 40 years. The untapped oil reserves have already been located. For this reason, the automotive sector faces a significant challenge and is putting efforts and knowledge into finding an alternative energy source. Manufacturers have created hybrid vehicles that run on the same fuel but have lower consumption. They are also researching hydrogen, another energy source that is highly dangerous due to its explosive nature but will be the energy source of the future (approximately 20 years).

Manufacturing. Currently, there are only 15 automotive groups in the world. The speaker estimates that 4 or 5 will be absorbed in a short time, leaving only 10 automotive manufacturing groups in a decade. Even if a manufacturer is absorbed, integrated, and centralized within the group, the strength of its brand persists. Nowadays, production is shifting towards markets, not like before when it was produced where the cost was lower. Additionally, car manufacturers are becoming less about manufacturing and more about assembly. They receive parts from various suppliers and assemble them, avoiding the need for inventory and reducing costs. Safety is also a major concern for manufacturers, with a third of their R&D budgets allocated to it. There are two types of safety: active and passive. The former involves designing systems to prevent accidents, while the latter focuses on minimizing the consequences of accidents. This is referred to as dual safety.

Another third of investments is allocated to the environment in order to minimize emissions pollution, fuel consumption, and increase the use of recycled materials. Currently, 85% of materials used in a car are recyclable.

Product. Needs change with the evolution of society. In the European Union, for the first time in history, more diesel cars than gasoline cars have been sold. Specifically in Spain, 70% of cars sold are diesel and the remaining 30% are gasoline. Spaniards are increasingly buying more powerful cars; in ten years, the average engine size has increased from 1500 cc to 1700 cc. Sales of vans and SUVs have also increased, becoming popular choices.

Marketing. It is evident that the market is free but highly competitive. With today’s technologies, comparing prices online is easy, making the Internet a channel for inquiries but not distribution. Mercedes has the highest loyalty rate in the market, with a rate of 70%, compared to the average of 50% in Spain. Mercedes’ goal is to target younger people by manufacturing more sporty, attractive, youthful, and accessible cars in terms of price.

Statistics for Spain. The automotive sector is the third most important in Spain, after construction and tourism. It is also the third-largest European manufacturer. Currently, 7 groups with 11 brands have factories in Spain, and 80% of the production is intended for export. However, Spain has a lower motorization rate than the more developed countries in Europe.

After Mr. Carlos Espinosa’s presentation, the debate began, covering topics such as: Chinese market. The speaker reminded us that one in every five inhabitants of the planet is Chinese, and around 100 million Chinese have the possibility to buy a car. China currently has about 20 million vehicles. However, automobile production in China is limited, resulting in more demand than supply. China is undoubtedly an attractive market, and manufacturers are already undertaking the necessary steps to export to China. Nevertheless, Mr. Carlos Espinosa pointed out that negotiations are challenging, and China’s problem is that it lacks significant foreign exchange reserves. Currently, China sells cars to countries like Syria and Guinea Conakry. By 2010, it is estimated that China could export more to Europe than it imports, which could pose a serious threat to Europeans.

“Super López.” José Ignacio López de Arriortúa, an engineer from Amorebieta, with an impressive professional trajectory, triggered an unprecedented legal confrontation between two giants like General Motors and Volkswagen. This man revolutionized the concept of factories, their relationships with suppliers, and the auxiliary industry. He started as Chief Purchasing Officer and gradually revolutionized the automotive world with his work theories. His specialty and goal have undoubtedly been minimizing costs, teaching suppliers to reduce expenses.

Major mergers.

The automotive sector has lost a lot of its attractiveness to investors; it is no longer a booming sector as it was years ago. Additionally, manufacturers face various expenses and labor union pressures. Currently, Toyota has the highest stock value, while General Motors incurs a cost of $2,500 before even starting vehicle production, due to expenses related to healthcare and retirement.

Research.

NASA is involved in projects related to new energy sources. Manufacturers dedicate a significant portion of their investments to research. A vehicle with a range of 800 km has already been developed, but it has limited space and a very high cost. It is estimated that within 10 years, some of these vehicles will be seen on the market.

Suppliers. Companies that supply car manufacturers specialize in manufacturing certain products, making them strong but also very dependent.

Juliana Huerta Martínez